Burial Insurance

for funerals and final expenses

No exam required. Need help? Call 1.866.526.7264.

What is Burial and Final Expense Insurance?

Burial insurance, or Final Expense Insurance is a cash value whole life insurance policy that usually is offered between the ages of 45 to 85. The policy can often range between $2,000 to $50,000 (age restrictions apply). Over 90% of people who buy burial insurance are seniors. Since most of them are on a limited income, burial insurance cost dictates how much coverage they will end up purchasing. Many a times, you will also hear the phrase funeral insurance instead of burial insurance or, final expense insurance. They mostly mean the same. The idea is to make the funds available to your loved ones at the time of need.

In a nutshell, burial insurance is nothing but a kind of senior life insurance. There are dozens of life insurers that specialize in burial insurance plans, and we bring you most of these insurers to find the most suitable funeral expense plan for you.

It is important to note that these are mostly simplified issue plans. Therefore, there is no medical exam required to qualify for this coverage. The cost of burial can range between $8,000 to $25,000, depending upon your need and where you live. Once you are ready to protect your loved ones from financial embarrassment in the end, we shop the market for you to find you an affordable burial life insurance plan from one of the best burial insurance companies.

THE TRUTH ABOUT SENIOR LIFE INSURANCE - BURIAL INSURANCE AIN'T CHEAP

What are different types of burial or final expense insurance plans?

Simply speaking, there are four types of burial insurance plans out there. Which one these funeral plans you will qualify for depends mostly on your age, health, and lifestyle.

- Level coverage burial insurance plans – Simplified Issue

There is no waiting period. As soon the insurance company approves you and you pay your first premium, your coverage becomes active. In order to qualify, you answer a few questions about your health and lifestyle. These simplified issue Level whole life insurance plans cover you for the rest of your life. Most people who qualify for these plans are those who are not suffering from severe health conditions. - Graded burial insurance plans – Simplified Issue

Graded burial life plans usually delay fully activating the policy for a period of two or three years. If death occurs within this period of time, the insurer will pay and a percentage of the death benefit, usually 30% in the first year, 70% in the second year. After the graded period, the full coverage applies. If, however, death occurs due to an accident at any time after purchase, the policy offers a full death benefit. In order to qualify, you must answer a few health and lifestyle-related questions. The maximum coverage amount available in these plans varies by age and can range between $10,000 and $50,000. - Modified burial insurance plans (Return of Premium) – Simplified Issue

These burial insurance plans also delay fully activating the policy for a period of two or three years. If you happen to die during that time, instead of paying a percentage of the death benefit, the insurance carrier returns the premiums you paid with interest (usually between 5 to 10%) to the beneficiary. But if you live beyond the first two or three years (depending upon the carrier), 100% of the death benefit goes to the beneficiary federal income tax free.The accidental death clause applies if the death occurs due to an accident in the first two years. The insurance company will pay the full death benefit to the beneficiary. Accidental death nullifies the two year waiting period. The maximum coverage amount available in these plans varies by age and can range between $10,000 and $50,000. In order to qualify, you must answer a few health and lifestyle-related questions.

- Guaranteed Acceptance or Guaranteed Issue Burial Insurance Plans

These plans are available to those who do not otherwise qualify for any life insurance plan due to a severe health condition. These plans are also graded or modified and are the most expensive type of burial insurance plans.There is no exam or health questions to answer.

The usual range of coverage guaranteed acceptance plans is between $2,000 and $35,000. The funeral costs vary by states and counties.

A few of our highly rated and competitive companies offering guaranteed acceptance funeral insurance for seniors include AIG, Gerber Life and, Great Western Life Insurance. The application process is online and over the phone. You need to have access to an email address in order to e-sign the completed application.

What health issues cause waiting period from funeral insurance companies?

Whether you will qualify for a no waiting period final expense insurance or not, depends entirely upon you health. If you suffer from any one of the following health issues )but limited to), you will not be able to avoid a waiting period.

- AIDS or HIV

- Terminal illness (you’ve been given a life expectancy of 24 months or less)

- Hospice care

- Recent history of cancer

- Currently going through Dialysis

- Currently in the hospital, nursing home, skilled nursing facility, or hospice care

- Waiting for or have had an organ transplant

- Alzheimer’s or dementia

- Recent heart attack ( within the last 12 months)

- Stroke within the last 12 months (TIA mini strokes do not count)

- A heart surgery within the last 12 months

- A circulatory surgery within the last 12 months

- Chest pains (angina) within the last 12 months

- Insulin shock or diabetic coma within the last 24 months

- Anyone of these or a combination

Burial insurance and final expense life insurance with no waiting?

There are three factors that dictate how a life insurance company will qualify you:

- your health

- your age, and

- you lifestyle

If anyone of these can possibly cause your death earlier than expected, you are going to pay higher premium to get a no waiting plan, or qualify for a plan that has a waiting period of two years.

If your health is within the acceptable list of medical conditions, you may then qualify for a lower premium burial insurance plan with no waiting period. Different insurers have different preferences in terms of what they think is an acceptable medical condition.

For example, most companies must have your height and weight before they can even consider your application. But a handful of final expense insurance companies don’t even consider your height and weight. Some companies don’t have issues with people with diabetes taking insulin, while others see it as a higher risk to insure. CLICK HERE for a sample application with health questions. This will tell you how an insurer qualifies the risk. Your answers and your background check of your health record will determine if you will get an immediate coverage or coverage with a waiting period.

While traditional life insurance plans are very strict in underwriting, the final expense insurance plans are much more relaxed.

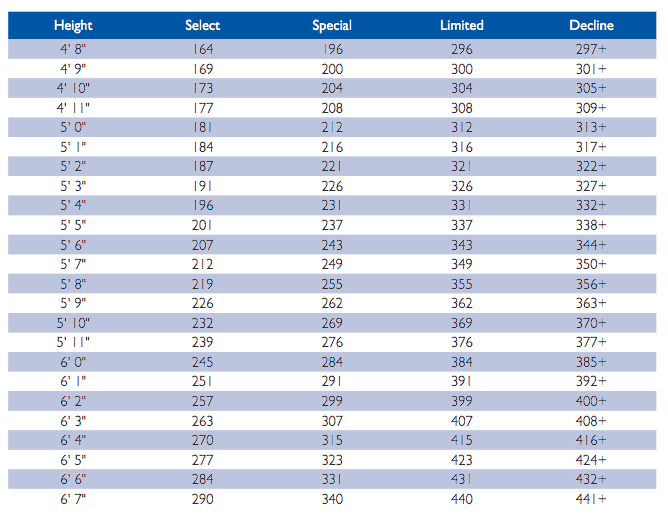

Height and Weight Chart for Final Expense Plans

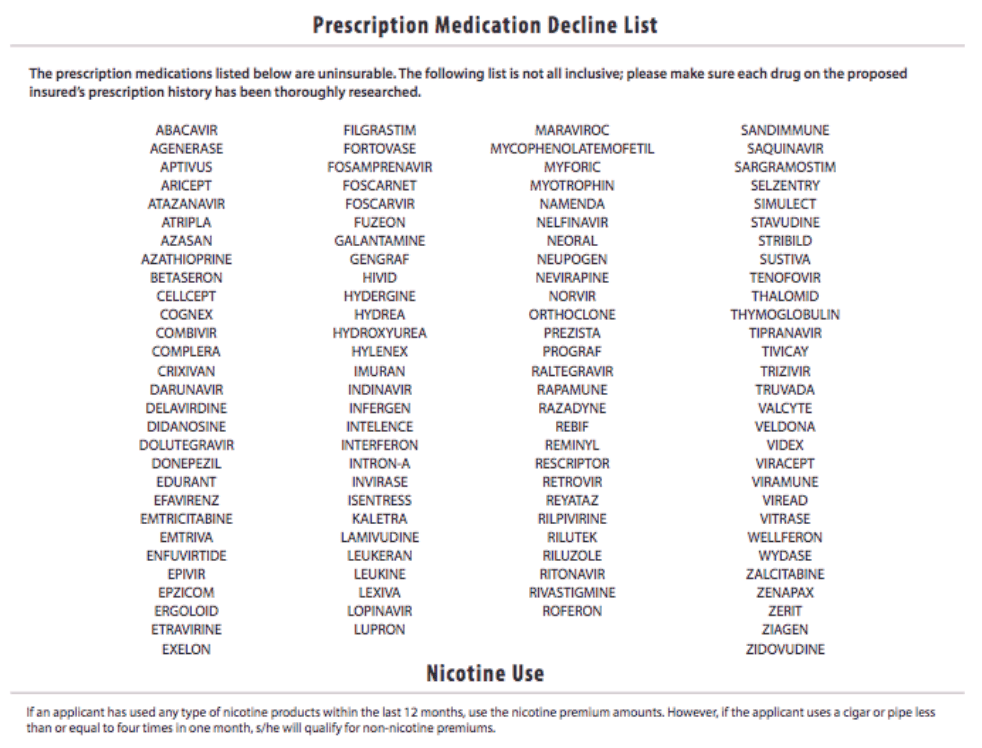

Drug List for Final Expense Insurance

Burial Insurance and Medicaid

The simple answer is that yes it can if it is not structured properly. In most states, a medicaid applicant cannot own more than $2,000 worth of countable assets. If after adding the borrowable cash value of your burial life insurance policy your net worth becomes over $2,000, you may lose your medicaid benefits.

To avoid this scenario the best answer is to make the beneficiary also the owner of the policy. When this happens, the cash value accumulation in the policy is not considered your countable asset. And, therefore no negative decision from Medicaid. Some folks also choose a funeral home to be the owner of their policy.

Best Burial and Final Expense Insurance

The best burial insurance plan is the one that you qualify for and, can afford to pay the premium.

All life insurance companies are legally bound to pay the promised death benefit upon of the death of the insured.

There is no one, or a list of best burial insurance companies. To use the word ‘best’ for one insurance company and leaving another highly rated company with a good, long history on the side, is simply unfair to the consumer.

It is important that you talk to an agent (that includes us at insureinminutes.com!) who has access to a bunch of companies and can really shop the market for you. That’s the only way you can get the most suitable offer.

Best Burial and Final Expense Companies for 2024

- AIG

- Americo

- Gerber Life

- Mutual of Omaha

- Royal Neighbors of America

- Guarantee Trust Life

- Sentinel Security Life

- United Home Life

- Great Western

- Transamerica

- Security National Life

- Liberty Bankers

- American Amicable

- Fidelity Life

- Royal Arcanum

Facts about Burial Insurance for Seniors

- There is no medical exam.

- All burial insurance plans are whole life policies with cash values and will cover you until the end of life.

- The premium once approved will not increase during the life of the policy.

- The face amount and death benefit will remain level.

- The policy cannot be canceled unless you decide to do so by calling, in writing or by stopping premiums.

- Since these are whole life policies, there is going to be cash accumulation over time.

- The death benefit proceeds will go income-tax free to your chosen beneficiary.

- The funds can be used any which way the beneficiary likes.

- Your coverage can be level(immediate), graded or modified. It mainly depends on how a company approves you.

- Most plans come with a 30-day money-back guarantee in most states.

Burial Insurance Riders

The availability of riders for final expense plans is subject to age and state availability. The most common riders are:

- Accelerated Benefit Rider

It is also referred to as Terminal Illness Benefit Rider. This free-rider offers a percentage of the death benefit if the insured is diagnosed with a terminal illness and the death is expected within 24 months or less. The insured who receives this advance can use these funds whichever way he or she likes. - Nursing Facility Waiver of Premium Rider

This rider waives the policy premium if the insured is admitted to a nursing home for 90 days or more. It can be attached to the policy at the time of purchase for a small premium. - Accidental Death Benefit Rider

This inexpensive rider becomes active when death occurs usually within 90 days of an accident. The death benefit, in that case, may double. - Waiver of Premium to Disability Rider

This optional rider waives the policy premium if the insured becomes disabled for a certain period of time. It is important to consider the restrictions before adding this rider to the policy. - Children and Grandchildren Term Rider

With this rider in place, the insured can purchase a small, usually, between $1,000 to $10,000 term life policy on the children or grandchildren. At later agreed upon date, this amount of this rider can be converted into a permanent policy.

Burial Insurance Rates in 2024

PLEASE NOTE

By regulatory laws, agents and brokers offering life insurance products cannot charge a fee for service from a client. Therefore, your premium is exactly what an insurance company asks for and not a penny more.

Also, there is no good or bad burial insurance company. The company that works for you, and gives you an affordable option in your health condition is the right company for you.

How to find an Affordable Final Expense Insurance?

- Apply for coverage as soon as you can after you turn 50. The longer you wait, the higher you pay.

- Your health will dictate if you will qualify for lower premium. To figure that out, you will need to call 1.866.526.7264 and talk a licensed burial life insurance agent, who will have access to multiple insurers to shop a suitable plan for you. Make sure that you have the names your medications ready.

- Final expense insurance or burial insurance is a simplified issue cash value whole life insurance plan. Simplified basically means that there is going to be no medical exam. If you don’t mind going through a medical exam, just apply for a traditional life insurance policy for better rates.

- Feel free to run real time burial insurance quotes using the quoting tool on this page. That will give you an idea of affordability. Call us at 1.866.526.7264 to see if you will qualify.

How to Pay for Burial Insurance?

Most burial insurance carriers accept checking or savings account and, debit cards as a method of payments. A few of of the carriers also accept Social Security Direct Express Card for monthly billing.

A very limited number of insurance companies offer paid-up policy options of 20-pay, 10-pay, and single pay. By paying like this you can also end up paying less for the same burial insurance in the long run. If you are interested in making limited payments so you don’t have to pay premiums for the rest of your life, give us a call at 1 818 808 0090 or send us a message to Team@InsureInMinutes.com.

Besides the basics, you will need to provide your social security number, driver license number or, state ID and, your method of payment information(that may include your checking or savings account, credit or debit card).

No company will accept your application without that. For help, call to talk to one of our licensed agents at 1.866.526.7264.

FREQUENTLY ASKED QUESTIONS (FAQ)

Yes, these are.

Burial insurance, also known as funeral insurance, is a type of life insurance policy that is designed to cover the cost of funeral expenses after a person’s death. Medicaid is a government-funded healthcare program that provides coverage for low-income individuals and families.

When it comes to burial insurance and Medicaid, there are certain limitations that you should be aware of. In general, burial insurance is not considered an asset for Medicaid eligibility purposes, meaning that it will not count towards your income or assets when determining your eligibility for Medicaid.

However, there are limits to how much burial insurance you can have while still qualifying for Medicaid. In most states, the maximum amount of burial insurance that you can have and still qualify for Medicaid is $1,500. This means that if you have burial insurance policies that total more than $1,500, you may not be eligible for Medicaid.

It’s important to note that the rules around burial insurance and Medicaid can vary depending on the state you live in. Additionally, there are other factors that can impact your eligibility for Medicaid, such as your income and assets.

In the context of Medicaid, “spend down” refers to the process of reducing your income and assets to meet the eligibility requirements for Medicaid. The spend down process is also known as “medically needy” or “income spend down.”

To qualify for Medicaid, your income and assets must fall below a certain threshold. If your income or assets are above this threshold, you may still be able to qualify for Medicaid through a spend down program. Essentially, you would be required to spend down your excess income or assets on medical bills or other allowable expenses until you meet the eligibility requirements for Medicaid.

For example, let’s say that your income is $2,500 per month, and the Medicaid income threshold in your state is $2,000 per month. In this case, you would be over the income limit and would not qualify for Medicaid. However, if you have $500 in medical bills each month, you may be able to use the spend down program to qualify for Medicaid. You would be required to pay the $500 in medical bills out of pocket each month until your income falls below the $2,000 threshold, at which point you would be eligible for Medicaid.

It’s important to note that the spend down rules and thresholds can vary by state, and the process can be complex.

An irrevocable funeral trust is a type of trust that is set up to provide funds to cover the cost of funeral expenses. It is called “irrevocable” because once the trust is established, the grantor cannot change the terms or access the funds without the consent of the trustee.

The purpose of an irrevocable funeral trust is:

- to protect the funds set aside for funeral expenses from being used for other purposes, such as paying off debts or taxes. This ensures that the funds will be available to pay for funeral expenses when they are needed.

Typically, an individual will establish an irrevocable funeral trust by transferring assets into the trust. The trustee then manages the assets and invests them to grow the funds. When the individual passes away, the funds in the trust are used to pay for funeral expenses.

In addition to protecting funds from being used for other purposes,

- an irrevocable funeral trust can also help an individual qualify for Medicaid benefits. Medicaid has strict asset and income requirements, and setting up an irrevocable funeral trust can help an individual meet those requirements while still ensuring that funds are available for funeral expenses.

Unless you bought a term life burial insurance policy, most burial insurance plans are whole life insurance with cash values. This type of policy does not expire as long as the premium is paid on time.

Between $8,375 to $25,170, depending upon the choices made.

Burial insurance covers expenses involved in the arrangements of the insured’s funeral, like burial, service cost etc. Based on where you live, and what kind of funeral you, or your family have planned, the cost can range between $5,000 to $20,000. The death benefit of burial insurance goes federal income tax free to the beneficiary who can use the funds to of care of the expenses.

Final expense on the other hand is the gamut of expenses involved in the closing your life file. This can include estate taxes, medical expenses, or any other unforeseeable expenses that your beneficiary will have to face once you are gone.

Burial insurance and final expense insurance are usually interchangeable names of the same thing.

These plans are simplified whole life policies. This basically means that the insurance company will look into your medical history but will not ask you to go through a medical exam. Usually, there can be a phone interview to verify your existence and to confirm the information you provided. It is also done to make sure that no one forced you into purchasing.

The entire exercise takes place over the phone and the insurance company’s secure portal. The approval of your application can, therefore, take from a few minutes to a couple of days.

Of course, you can.

The fact that you could be responsible for the burial and othe final expenses makes you a person with ‘insurable interest’.

Husband, wife, domestic partner, children, grand-children, they all have insurable interest making sure that you have a life insurance, or a burial insurance policy.

This will save them from having to look for funds to give you a decent burial.

Unless the applicant’s health is bad or severe, this doesn’t happen. Under traditional life insurance scenario, you are hard to insure or uninsurable. The burial insurance policy in that case will give you a graded or modified coverage.

Absolutely!

Most insurances companies allow that. In this case the child will be the owner of the policy and the parent will be the insured.

No.

By law the life insurance brokers cannot charge you even a penny over the company’s quoted premium.

Therefore, no matter you go, your premium will always be the same.

In simple terms, collateral assignment in burial insurance means using the burial insurance policy as a guarantee for a loan or debt. When you have burial insurance, you can assign the policy to a lender to show that if you pass away and there’s still an outstanding loan, the lender will be paid from the insurance money before it goes to your family or beneficiaries. It’s a way to use your burial insurance as security for the loan you’re taking.

Some organizations and government agencies offer free burial insurance or assistance to people with low income who can’t afford burial expenses. For example, some states have programs through their Department of Social Services or Department of Aging, and nonprofit organizations like Catholic Charities or the Salvation Army may help too. Some funeral homes also have programs for low-income families.

Eligibility requirements for these programs vary, and there may be limited funds. If you need burial assistance or free burial insurance, research programs in your area and talk to a social worker for help in finding available resources.