No Medical Exam Life Insurance

What is no Exam Life Insurance

No medical exam life insurance basically means that nobody will come to draw your blood; take your urine sample; confirm your height and weight, or run an EKG, if needed. The approval process also is very quick. Instead of months, you may get your active policy in hand in a matter of days or even minutes. Besides the fast approval, the convenience of getting a life insurance is a big attraction for many.

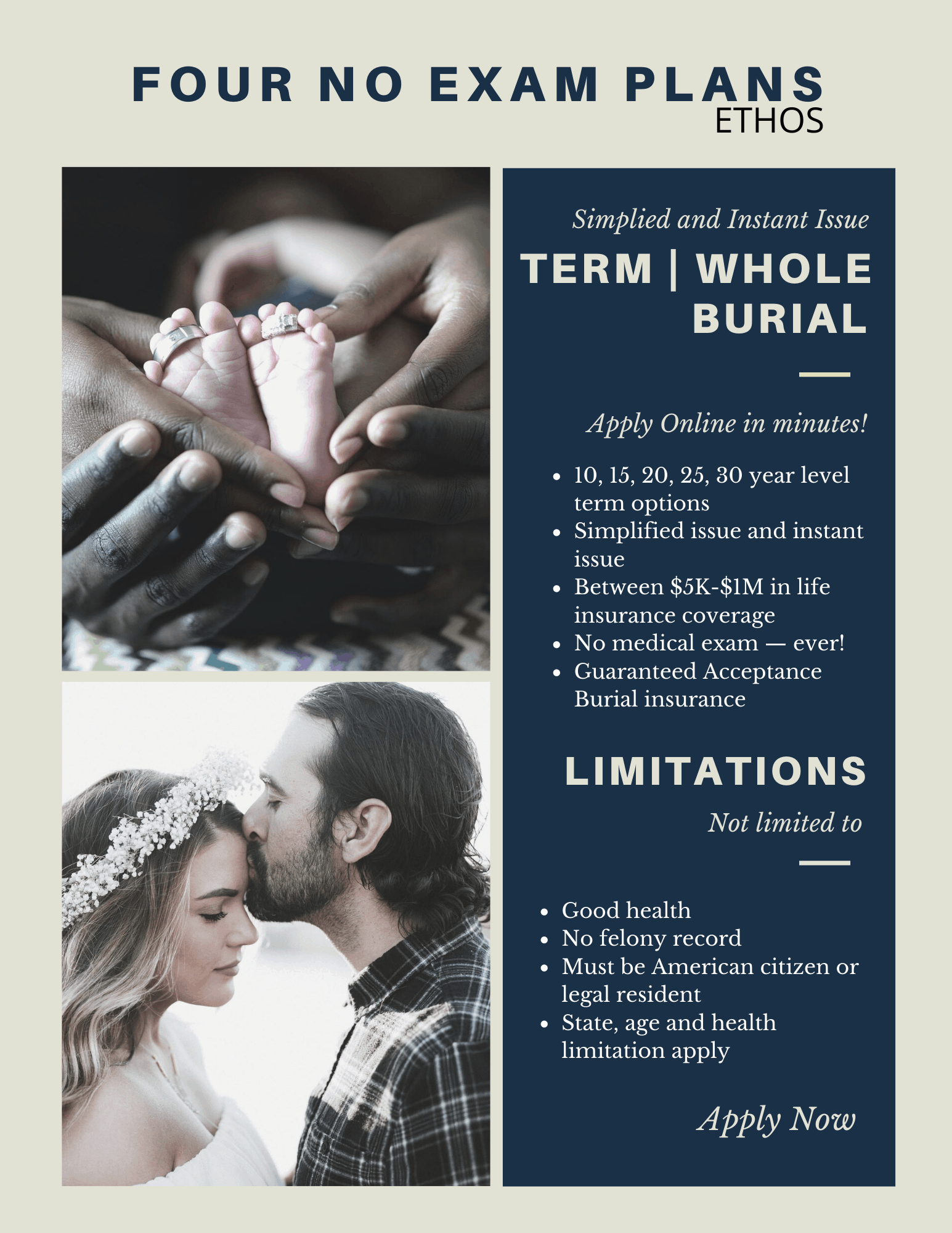

ETHOS NO EXAM LIFE

Best Life Insurance with no Medical Exam

You can get up to $2,000,000 affordable coverage without having to take a physical exam. Sometimes the approval for life insurance can be instant as soon as we submit an online application for you.

For this to happen, you need to be in a reasonable health. This process makes it faster to get a life insurance policy. Also, if you are one of those who hate fasting and needles, you might want to consider this option.

Due to the amazing advancements in digital technology, many life insurers today offer a simplified issue, no-exam option to the clients. A few of our A+ rated carriers include North American, Banner Life, Assurity Life, Principal Life, Lincoln Financial, Pacific Life, Penn Mutual Life and SBLI. They all offer affordable no exam life insurance.

Only a handful of them offer instant-issue life insurance.

Now, to find the best coverage may turn out be a little tricky. Except for convenience, it may not be the best option unless you are 100% sure that you want a term life insurance only and do not want to take a medical exam, or wait for a long time for approval. If you are planning to convert your term life insurance policy into a whole life or universal life plan in future, you must ask about the availability of conversion plans before you buy a term life insurance, especially, no exam term life insurance.

Restrictions on age, health and state availability may apply.

These, mostly, term life insurance plans work well when you are considering:

- income replace for the beneficiary

- mortgage protection

- funding college education

- protection of loans

Difference between Instant Issue life Insurance and No Exam Life Insurance

Both of these require no medical exam. Therefore, they are called simplified issue. In case of instant issue life insurance, you will get an approval or disapproval as soon as you finish entering your basic information needed to qualify you. The whole process may take anywhere between 5-10 minutes. In that regard, these can be called the life insurance plans without any waiting period, and no medical exam.

No Medical Exam Life Insurance

This require no medical exam. Therefore, they are called simplified issue. In case of instant issue life insurance, you will get an approval or disapproval as soon as you finish entering your basic information needed to qualify you. The whole process may take anywhere between 5-10 minutes. In that regard, these can be called the life insurance plans without any waiting period, and no medical exam.

No medical exam life insurance can be a great option for those in a rush and, those who hate needles. All burial insurance plans for seniors do not require a medical exam. To determine if a non-med life insurance is the right choice for you, please call us at 1.866.526.7264.

What is Simplified Issue Life Insurance?

In order to qualify for this type of plan you only have to answer a few questions. There is no medical exam, No blood blood. No urine. With the information you provide on your application, the underwriter at the insurance company does a background check of your health history. Based on that, you risk class and the premium is determined. Instead of a few weeks to a few months that it takes to get an approval for traditional fully-underwritten plan, the decision in this case may take just a few days. A reasonably health is usually a requirement to qualify for simplified issue insurance unless you are considering burial insurance, or funeral insurance.

What is Instant Issue Life Insurance?

It is similar to simplified issue life insurance where you only have to answer a few questions. There is no medical exam, No blood blood. No urine. With the information you provide on your application, the underwriter at the insurance company does an instant background check of your health history and other information. Based on that, you risk class and the premium is determined. The decision of approval or disapproval is made within minutes (usually while you finish completing the application).You need to be in almost perfect health to qualify for instant issue insurance. Once again, for an instant issue burial insurance, you don’t to be in great health.

No Exam Life Insurance Rates

| AGE: 35 | RISK CLASS: SUPER PREFERRED | NON-SMOKER | |

|---|---|

| TYPE OF COVERAGE | MONTHLY PREMIUM (Male/Female) |

| INSTANT ISSUE 20 Years Term (NO MEDICAL EXAM) | $26.42 / 19.75 |

| NON-MED TERM 20 Years Term (NO MEDICAL EXAM) | $21.07 / 17.63 |

| INSTANT ISSUE 30 Years Term (NO MEDICAL EXAM) | $52.67 / 36.00 |

| NON-MED TERM 30 Years Term (NO MEDICAL EXAM) | $34.77 / 29.22 |

| Please note: The rates quoted are estimates and are subject to underwriting by the insurance carrier. Rates do not include optional riders. For a no-obligation consultation, call us at 1.866.526.7264. |

|

How to Qualify for No Exam Life insurance

The most important factor that determines whether you will qualify for a no medical exam life insurance is your health. Lately, a few of the top-rated traditional life insurance companies have introduced accelerated underwriting to facilitate a quick approval for the applicants. With this place, you can have an active life insurance coverage within a few minutes to a few days. There is no more waiting for weeks, or sometimes months to get an approval. However, there is a caveat. You need to be in good health.

Who Qualifies for a No Medical Exam Life insurance

- You need to be between 16-80 years of age. Age restrictions apply to how long a term(10, 15, 20, 25, 30) you qualify for. The other no exam life insurance for seniors is burial insurance or final expense insurance.

- There has to be an evidence of routine medical care in the past 2-3 years.

- You have not been rated at higher risk or declined in the past by an insurance company.

- Most carriers have mandatory electronic application submission process to consider you for a no exam approval process. This means that you have to give us a call (LOL!). We will access the insurance company’s secure portal; complete the application and send it to you in your email for you to review and sign(e-signature). Once you sign, we will then counter-sign and submit your application.

Based on your income, you can apply for up to $2,000,000 in non-med term life insurance coverage.

Our secure, online quoting software is designed for you to select your life insurance plan and fill out your application in a matter of minutes.

Which life insurance companies do not require medical exam?

A growing number of life insurance companies today offer what is called Simplified Issue Life Insurance. To qualify for this, you need to be in good health or at least in reasonable health. Once the application is submitted, the underwriting does an instant background health check. After that they decide if an applicant can qualify for a no-exam life insurance or not. At the same time a few of the very reputable life insurers have introduced instant issue life insurance plans that you can buy online within a few minutes. We encourage you to give us a call at 1.866.526.7264 if you have any questions, or if you need help applying.

- North American – BESTOW (Term Insurance)

- Assurity Life (Term Insurance)

- Pacific Life (Term Insurance)

- Penn Mutual (Term Insurance)

- Lincoln Financial (Term Insurance)

- AIG (Guaranteed Acceptance Final Expense Insurance)

- Gerber Life (Guaranteed Acceptance Final Expense Insurance)

- Banner Life – ETHOS (Term Insurance)

- Transamerica (Term Insurance)

- Prudential (Term Insurance)

Calculate term life and universal life insurance premiums. Check your real-time premiums here.

By using the quoting widget to “Display Quotes”, and submitting an online insurance quote and application request, you are providing Coverage Alliance Insurance Services/Dan Kampani with your prior express and written consent to contact you at the cell phone number or residential phone number, and email provided. Final rates are based on eligibility. You can also reach us toll-free at 866.526.7264.