By now, I must have talked to a few thousand people looking into life insurance to protect their loved ones. I have not met a single person who wants to pay a premium forever. Whether it is a car, a house, or a life insurance policy, as soon as you are done paying the final premium, there is a special kind of relief as if a pall of freedom just dawned over your life.

What is Limited Pay Life Insurance?

Most of these plans are either universal life or whole life insurance plans. Both are custom-designed to suit what the client wants. You can choose to pay a single premium for your life insurance policy or spread the payments over the years.

A couple of years back, a 34 years old female in good health came to me through a referral. She had a guaranteed universal life insurance plan that covered her until the age of 121. She was paying about $90 per month to keep that policy. She was glad about the fact that unlike a 30 years term insurance, her policy will keep her covered for entire life. So I asked her, “Are you comfortable with the fact that you will pay your premium until age 100.” “I wish I don’t have to,” was her answer. Very logical and reasonable.

Long story short, since she purchased that policy only in the last one year, I managed to find her the best class premium from an A+ rated carrier and she agreed to pay a premium of $125 monthly only until the age of 65. After that, the guaranteed universal life policy would continue until the age of 121. Not a single extra premium had to be paid after age 65. In my experience, most people would like to have something like that if they can afford it. Nobody wants premium on a life insurance policy forever.

Single Pay Term Life Insurance

A handful of life insurance companies offer their customers to pay a single premium on a term life insurance plan. By choosing this option, you can end up saving up to 33% on the total premium of a 10, 15, 20, or 30 years term policy.

If you want a personalized quote on single premium term plan, give us a call at 1 866 526 7264.

Single Pay Universal Life Insurance

Most of these plans are guaranteed universal life plans with almost to no cash values. Their biggest benefit is:

• that you will never pay another premium, and

• your loved one will have the financial protection from your life insurance policy as long as you live.

(I am assuming that no one lives all the way to 121).

Single Premium Life Insurance

Single Pay Whole Life Insurance

Most of these plans are participating or non-participating plans with cash values. Their biggest benefit is:

• that you will never pay another premium, and

• your loved one will have the financial protection from your life insurance policy as long as you live.

• that if you have a participating whole life plan, your death benefit or face amount of the policy will also increase over time. That works as a kind of inflation protection.

• that you can borrow loans from your own cash values in the policy and pay back with time.

• that this method of self-financing can be successfully used of you start with a whole life plan early in life.

What is Modified Endowment Contract (MEC)?

A simple explanation is that is it an overfunded life insurance policy. The only time MEC makes a difference is when you have large cash values in the policy. Without those MEC is inconsequential.

A modified endowment contract gets the same treatment as a non-qualified annuity contract.

How to Avoid a MEC?

• Make limited premiums into the policy for few years ( 7 years and above).

• If you want to get a single premium whole life insurance, make sure that the company offers a premium deposit fund.

“It is an account that allows you to pre-pay policy premiums with one lump sum, without causing the policy to be a Modified Endowment Contract (MEC). This allows your policy to keep the favorable tax treatment provided by life insurance while earning a competitive interest rate.

Each year, the specified annual premium is automatically transferred from this account to your life insurance policy. This is a convenient and systematic way to fund your policy, while providing you with peace of mind.” (source: Penn Mutual)

It's peace of mind for a lifetime.

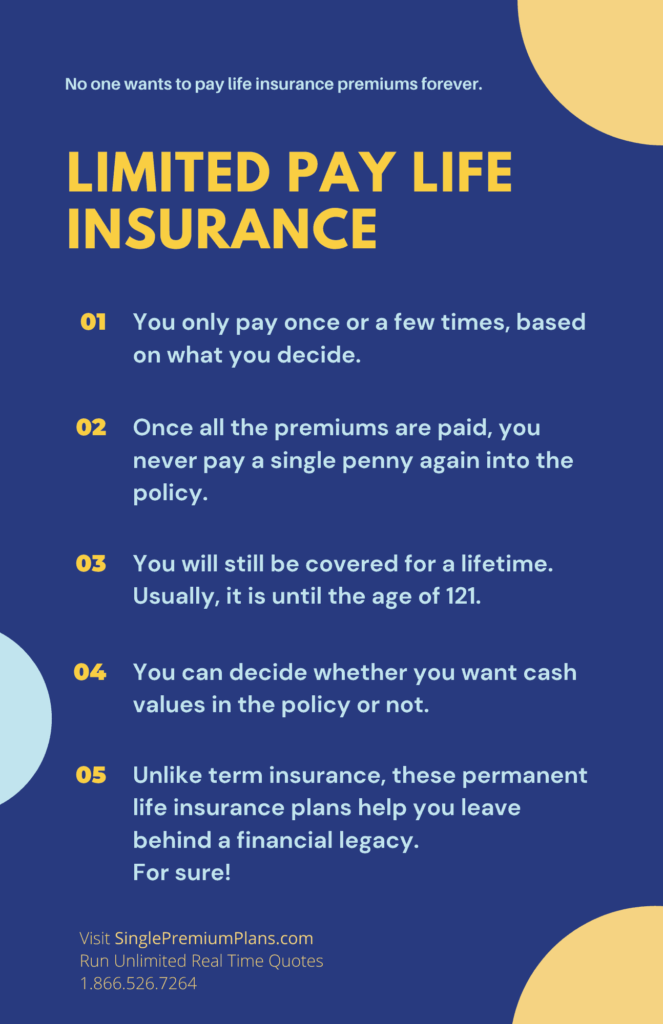

Limited pay life insurance plans are simply custom designed plans that allow you to pay your premiums for as long as you want to pay into the policy while making sure that the policy remain active for whatever number of years you choose. Usually, guaranteed universal life and whole life insurance plans offer coverage until the age of 121.