The need for life insurance depends on your individual circumstances, financial situation, and responsibilities. Here are some factors to consider when deciding if you need life insurance:

Dependents: If you have dependents, such as a spouse, children, or aging parents, life insurance can provide financial security for them in the event of your death. It can help replace your income and cover their ongoing expenses, such as housing, education, and daily living costs.

Debts: If you have outstanding debts like a mortgage, car loans, or credit card debt, life insurance can ensure that these debts are paid off if you pass away, preventing the burden from falling on your family.

Financial goals: It can also be a tool for achieving long-term financial goals. It can provide funds for your children’s education, supplement your retirement savings, or leave a financial legacy to your beneficiaries.

Co-signed loans or joint financial responsibilities: If you share financial obligations with someone else, such as a business partner or a co-signer on a loan, life insurance can protect them from shouldering the financial burden in case of your death.

Estate planning: It can facilitate the transfer of assets and wealth to your heirs or beneficiaries, especially in cases where your estate might be subject to estate taxes.

Peace of mind: It can provide peace of mind knowing that your loved ones will be financially secure if something were to happen to you.

On the other hand, if you’re single, have no dependents, no significant debts, and you have enough assets to cover your final expenses, you may not have an immediate need for life insurance. In this case, the decision to purchase life insurance might be driven by other factors like leaving a legacy or using it as an investment or tax planning tool.

Compare and Apply with Confidence

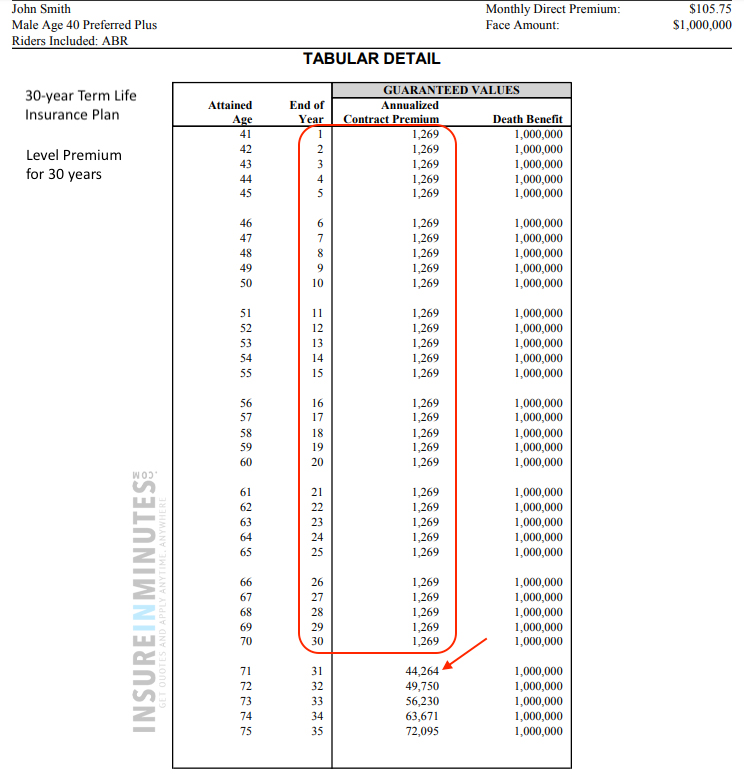

Finding affordable life insurance is now easier than ever. You can compare and apply for policies with terms of 10, 15, 20, 25, or 30 years.

Term Life Insurance – Affordable coverage for a set number of years.

Return of Premium (ROP) Term – Get back all your premiums at the end of the term (minus any loans).

For those considering lifelong protection, we also offer permanent life insurance options:

Whole Life Insurance – Lifetime coverage with guaranteed cash value growth.

Universal Life Insurance – Flexible lifetime coverage, with or without cash values.

Apply online or simply give us a call and we’ll help you design a plan that matches your goals and budget. Call 866.526.7264.