Affordability Matters

Term life insurance is perhaps the most sold life insurance plan in America. One of the biggest reasons is that term life offers you the highest death benefit for the lowest premium.

Limitations of Term Life Insurance

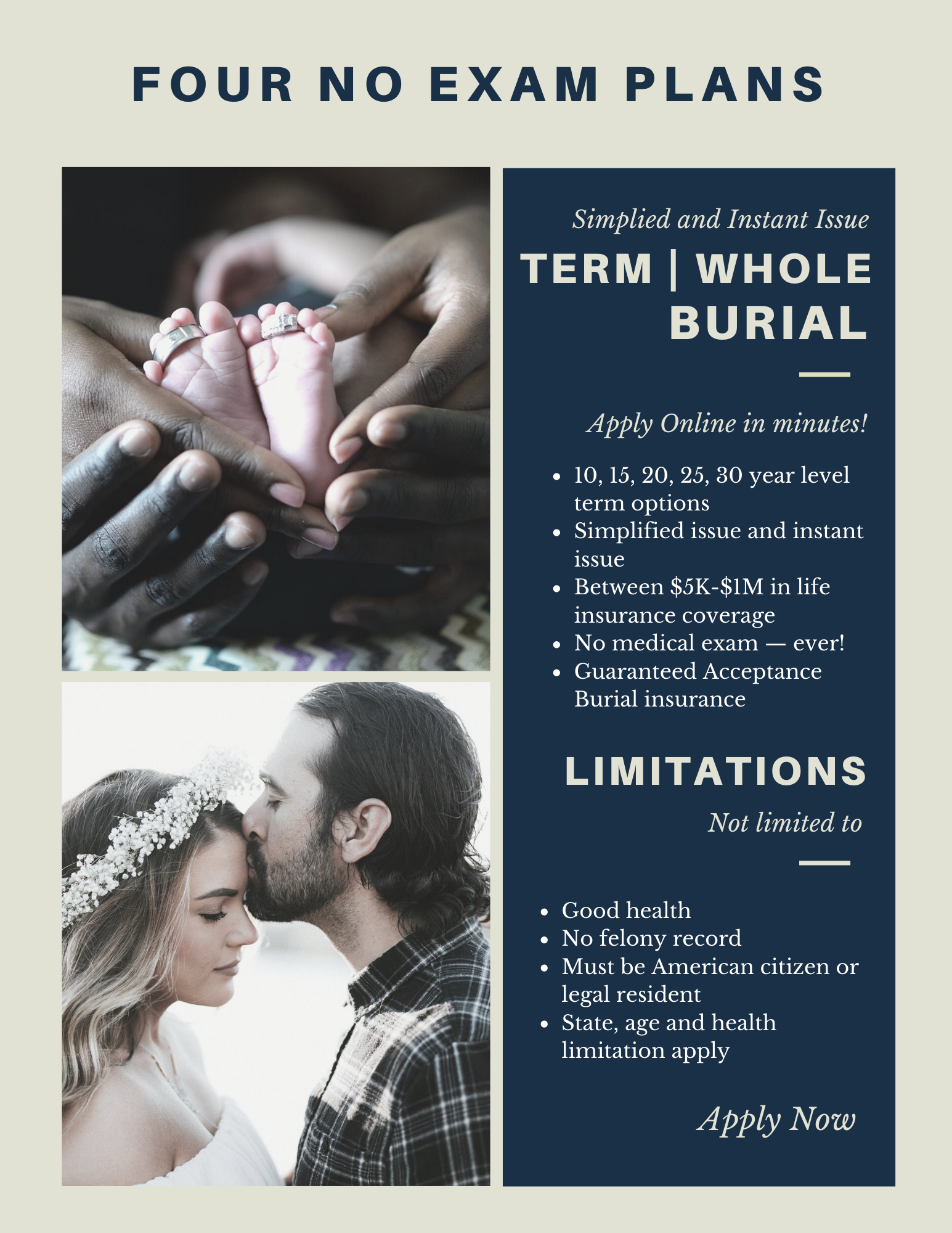

It covers you for only a specific period of time at a level premium and works like renting or leasing. Usually, the time spans are 10,15, 20, 25 and 30 years. A couple of companies have also introduced 35 and 40 years term (age and state restrictions apply). AIG offers a term plan which allows a applicant to select any number years between 10 and 35. If you happen to die within that time, your beneficiary will receive the life insurance proceeds federal income tax-free.

But if you live through that period, the premiums you paid for those years are gone.

To counter that disadvantage, a few life insurance companies offer a return of premium term life insurance options. These plans cost you more, but at the end of the term, you get a refund of all the premiums you paid, minus any loans. No matter which type of term life insurance you take, at the end of the term you have no coverage on yourself.

Renewable Term Life Insurance

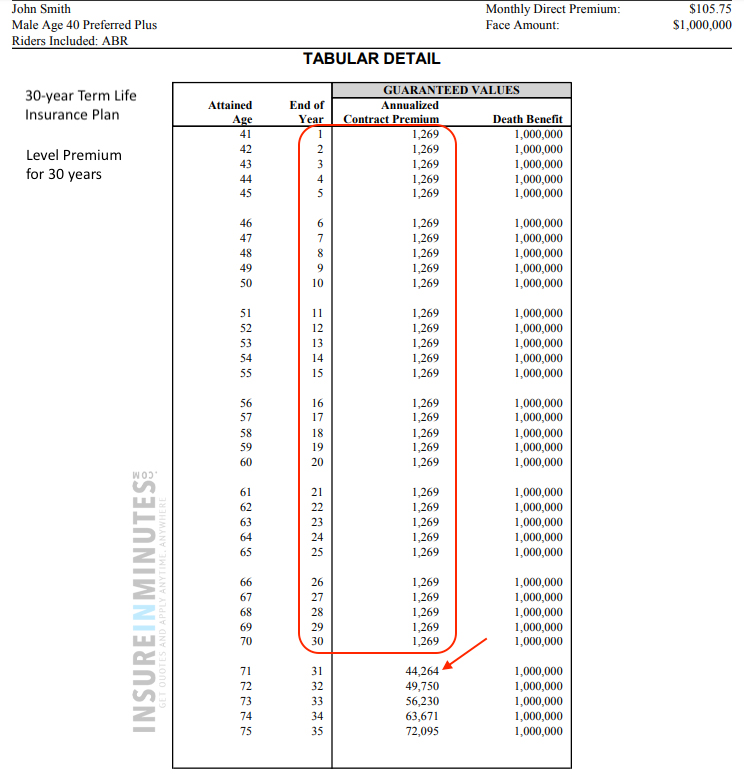

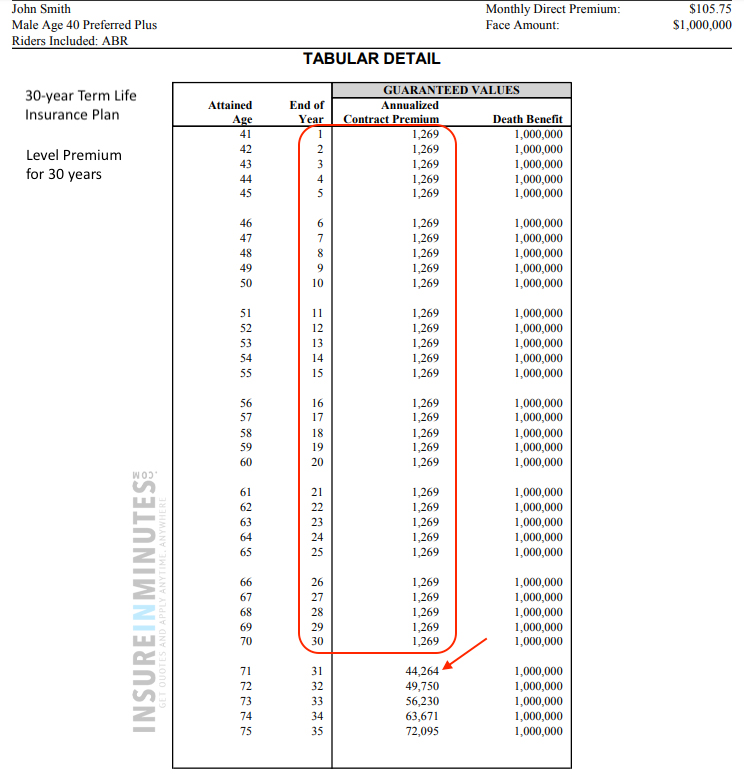

Now, most term life insurance plans are annually renewable at the end of the term. However, it is financially impossible for most people to maintain a term life policy after the term ends. The rates are exorbitantly high. For example, a 40 years old male can pay as little as $105.75 per month or $1,269 annually for a 30-year term insurance for a $1000,000 coverage. At the end of 30 years, if he wants to renew his policy, his premium jumps from $1,269 to $44,264 per year. Also, the premium keeps increasing every year thereafter. So renewability of a term insurance policy is really a joke. Refer to this image below for details.

For some people, this product works like a charm. It protects the family’s ability to keep on paying the mortgage on the house or any other loan in case of sudden death of the income provider. It also provides much needed financial protection to the family when children are growing up. Basically, term life insurance works well when you want to cover temporary financial obligations.

For those who are looking for a longer term of coverage guaranteed universal life insurance is the best option.

LIFE INSURANCE QUOTES

Financial Heaven or Hell

I recently met someone who purchased a $1M, 20-year term life insurance with a thought that after twenty years he will not need any kind of life insurance because he will by that time make it financially. The guy is a 42-year old realtor and is not my client. I really hope and wish that everything works out for him the way he has planned his finances. BUT…what in case they don’t!

He has a mortgage, a young 11-year old daughter, and a non-working wife.

What if his wife outlives him by 10 years much later in life when he has no life insurance on him? If his financial gains are strong and the income is going to continue even after when he is gone, the spouse will do just fine. Otherwise, she will have to go through a financial hell that the realtor has not anticipated.

In the last 20 years, I have talked to a number of people who bought term life when they were young and later in life wanted permanent coverage that could last until the end of life. The only reason they bought term life insurance was because it was the least expensive option.

By the time, they come to this realization; many of them cannot afford to buy a permanent life insurance plan (coverage beyond age 100) or end up paying very high premiums. Your premium at this stage is based on your current age and health. The older you are, the higher you pay, even if you are in good health.

Options to Convert Term Life Insurance

Most term life insurance plans come with an option to convert the entire or partial amount of death benefit to a permanent life insurance plan (coverage beyond age 100). The time period within which you can convert depends on what the carrier offers.

The biggest advantage of conversion is that the insured doesn’t have to go through a medical exam to qualify. You may have any number of illnesses or diseases but you cannot be clinically disabled. Just agree to pay your new premium and you are set. Also, you can mostly convert the entire term policy or part of the policy into a permanent plan.

The biggest disadvantage is that the longer you wait to convert, the higher you pay.

I always suggest my clients to layer their life insurance plans, depending on what they can afford and what their needs are today and also their anticipated needs in the future.

It is important to mention that one can have multiple life insurance policies to take care of various kinds of needs in life.